We’re back with Part Three in our series.

With Open Enrollment coming up this fall, we want to dive deeper into what goes into the premium rates that employers and employees pay. There are a lot of different factors that go into premium payments, while trying to keep health care as affordable as possible.

What goes into determining a premium rate change?

It really varies, based on many factors, but the main items we consider when determining premiums for fully insured plans are:

(UNIT) COST. These are the fees for care and services that health insurers negotiate with hospitals, physicians, pharmacies, and other health care providers. This also includes the increasing prices of prescription drugs and durable medical equipment.

- This is the number of medical services and prescription drugs people use. When more people use more medical services, costs can increase.

- This is when a treatment or procedure is replaced by a more expensive one. New treatments and new drugs typically cost more.

- ADMINISTRATIVE costs are the normal expenses needed to run a health insurance business, including the costs associated with processing claims; providing customer service; maintaining a clinical staff to support navigation of care; processing enrollment and billing; and paying government taxes/fees.

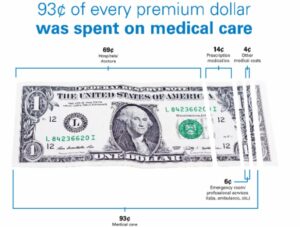

In 2023, Univera Healthcare used 93% of premium dollars on patient care, including medical and pharmacy claims, and activities that improve the quality of care. Premium increases are primarily driven by increases in the cost, utilization, and intensity of services used by our members.

Maintaining quality while combatting rising costs

We have a variety of innovative programs that focus on the care of our members, while also helping to control costs. We offer services to help manage costs related to medications, chronic conditions, overall wellbeing, and more, including:

Pharmacy Programs: All of our fully insured plans include programs aimed at helping members get the care they need while keeping costs down, including home delivery, site of care programs, and Pharmacy Concierge. Many programs are also available to Self-Funded plans for no additional cost.

High-Cost Care Programs: Through our Care Management team, we ensure all members—but especially those with chronic or complex conditions, or those managing multiple health concerns at once— are supported through:

- Customized outreach

- Education

- Assistance with interpreting their benefit package and claims history to identify potential solutions or ways to improve care and reduce costs.

We’ll talk more about this in our PART FOUR of our series.

Chronic Condition Management: Barriers preventing members from achieving their health goals are identified by a team of registered nurses, registered dietitians, behavioral health specialists, and social workers. This team partners with members to provide education and recommend testing and screenings.

Preventive Care Programs: This includes routine checkups, screenings, and immunizations. We offer resources like our Pharmacy Price Check tool, our Find a Doctor tool to ensure a member’s provider is in-network, care management support and a free 24/7 nurse call line for non-urgent health questions. Plus, the Wellframe® app gives members instant access to a dedicated care manager, dietitians, nurses, and other health care professionals who can connect them with health management programs right in the app.

If you have any questions about what goes into premium rates or need help as you’re getting ready for Open Enrollment, please contact your account manager or broker.

With PART FOUR of our series, we'll share some available programs that can provide care management support to members with complex conditions and high medical bills.